Embed financial services into your products

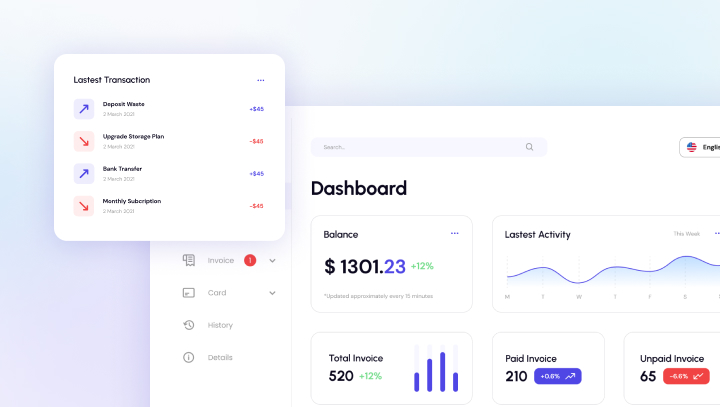

Develop and release applications that empower your clients to store funds in their digital wallet, settle payments, generate virtual cards, and engage in numerous additional activities

Automate payments from initiation to reconciliation

Discover the powerful features that make Monicredit FAAS the ultimate financial automation solution

Onboard users in minutes

Monicredit handles Know Your Customer (KYC) obligations for payments and helps you meet other requirements for payments compliance.

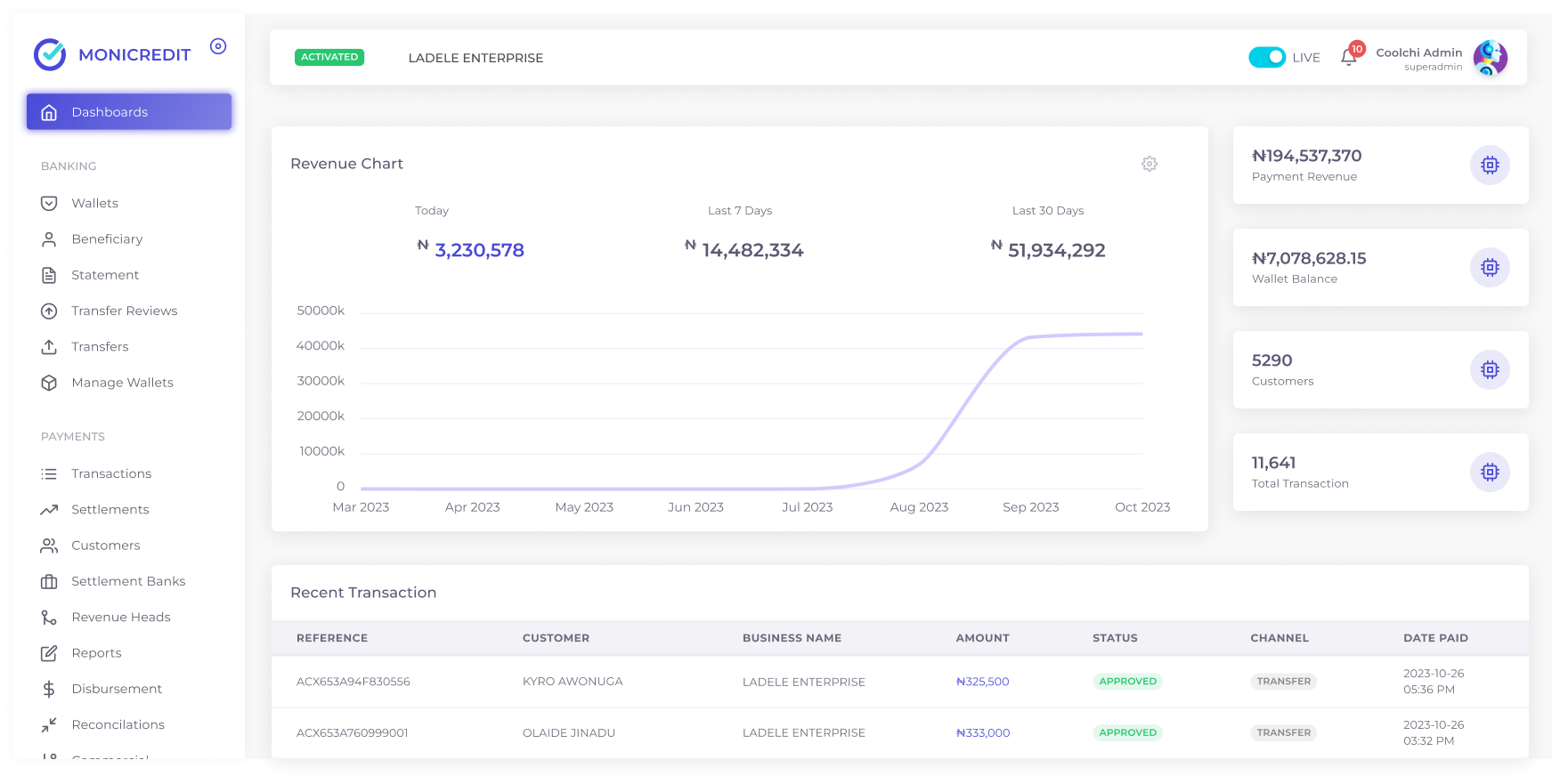

Manage your platform

You can split funds between multiple users, instantly route payments across borders, and specify your earnings on each transaction

Accept payments

Monicredit FAAS helps keep full records of all transactions so that you can easily track and reconcile payments even without writing codes

Build your payments business with speed and flexibility

- KYC: Facilitate your customers' identity verification in one call

- Account opening: Open and manage branded consumer and business deposit accounts using our developer-friendly APIs.

- Debit cards: Instantly issue and process branded virtual and physical consumer and business debit cards

- Payments: Execute custom ACH, bill pay and real-time transfers through a single endpoint.

- Compliance: With built-in compliance, we do the heavy lifting so you don't have to.

Launch faster

Get to market faster without the upfront costs or development time usually required for payment facilitation, with Stripe hosted onboarding.

Drive revenue growth

Make payments a powerful source of revenue with our revenue share program, or mark up payments to earn on every transaction.

Unlock new revenue streams

Monetize Our complete suite of financial services products by offering financing, expense cards, or money management accounts to your users.

Core Financial Services

Core Financial Services within the Fintech as a Service (FAAS) framework encompass essential functions that are foundational to financial operations. These services are designed to streamline key aspects of financial management, ensuring efficiency, accuracy, and security.

- Streamline and secure financial transactions

- Mitigate and prevent financial risks and fraud

- Provide tools for effective investment portfolio management

- Enhance security and compliance in financial transactions

Enabling Technologies and Infrastructure

Enabling technologies and infrastructure play a pivotal role in the Fintech as a Service (FAAS) ecosystem, providing the foundation for seamless integration, scalability and innovation.

- Enables seamless communication between financial systems

- Utilizes scalable cloud infrastructure for secure, accessible, and cost-effective financial services.

- Leverages big data for insights, predictive analytics, and real-time monitoring through customizable dashboards