MoniCredit Digital Banking

We offer the technological infrastructure and operating system essential for the seamless operation of fully digital and automated banking.

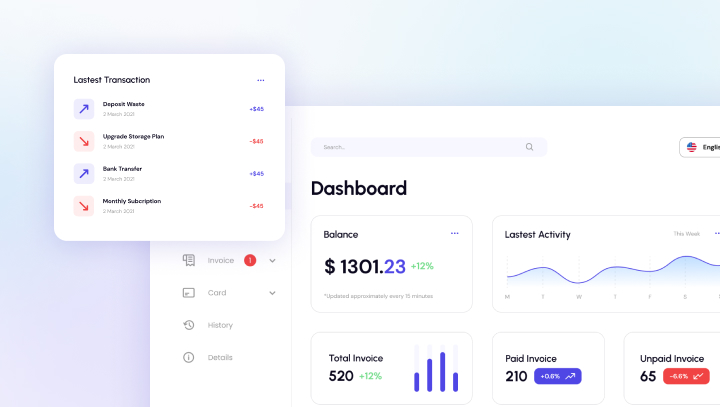

Automate transactions from initiation to reconciliation

Streamlined and efficient process of handling financial transactions electronically, from the moment a payment is initiated to the point where it is reconciled and recorded in financial records.

Ecommerce integrations

Seamlessly integration with ecommerce platforms, enhancing online stores by enabling smooth transactions

Online payments

Facilitates secure online payments, supporting various methods like credit cards and digital wallets for a streamlined customer experience.

Secure transactions

Prioritizes security, employing encryption and industry standards to ensure that customer transactions are safe and protected

Direct integrations to move money faster

Direct integrations to move money faster involve establishing seamless connections between financial systems or platforms to expedite the transfer of funds. By directly integrating systems, the traditional delays associated with manual processes are minimized, enabling quicker and more efficient movement of money. This approach streamlines the entire financial transaction process, reducing processing times and enhancing overall transaction speed

Seamless E-commerce Integration

Enhance your online business with Monicredit's seamless ecommerce integrations and our user-friendly payment plugin. Elevate your checkout process effortlessly. Boost your business now

Swift and Secure Online Payments

Experience the speed and security of online transactions with Monicredit. From credit cards to digital wallets, our platform supports various payment methods, offering your customers flexibility and convenience.

Direct Integrations for Lightning-Fast Transactions

Say goodbye to delays. Monicredit offers direct integrations that enable faster movement of money between financial systems. Experience the efficiency of direct connections for swift and reliable transactions.

Effortless Money Management

Monicredit is your one-stop shop for all things financial, conveniently accessible from your phone or computer. With its intuitive interface and user-friendly features, managing your money has never been easier.

- Double the security, double the peace. Password + fingerprint scan or one-time code

- Categorize your transactions, set spending limits, and stay on top of your finances effortlessly

- Schedule and pay all your bills conveniently, from electricity to internet, right from the app

- Enables instantaneous transfers and bill payments

Security & Peace of Mind

Your money and data are our top priority. Monicredit is built with cutting-edge security measures to ensure your financial information remains safe and protected. you can enjoy the convenience of digital banking without compromising on security

- Use extra layers like fingerprint scans or one-time codes for added security beyond your password

- Encrypting financial data in transit and at rest keeps it safe from unauthorized access

- Our advanced systems watch your activity for suspicious patterns & promptly alert you to risks

- Monicredit stays vigilant, alerting you to any unusual activity for added security

Frequently Asked Questions

How do I get started with MoniCredit?

You can register on https://monicredit.com/register or download the app on Google Playstore

What do I need to open a Monicredit account?

To open a Monicredit account, you must be at least 16 years old and you must have an email address, a phone number and a back verification number (BVN) or National Identification Number (NIN).

Why do you need my BVN?

We ask you to confirm your BVN so we can be sure no one is pretending to be you.

When you confirm your BVN, we match your details with the information on the national BVN database owned by the Central Bank.

We won’t use your BVN to access your other bank account(s).

What kind of account will I get?

If you sign up without verification, you will get an account limited to 100 Naira maximum debit and 50,000 Naira Maximum balance. If you sign up with your name, phone number and BVN (Bank Verification Number), you’ll get an account limited to a maximum balance of 500,000 naira, a maximum deposit of 50,000 naira at a time and a maximum transfer of 50,000 naira at a time.

If you add a government-issued ID (like your driver’s license, national ID card or international passport), we’ll remove those limits from your account.

Is my money safe with Monicredit?

Yes, your money is safe with us. We secure all accounts with the same high-security encryption used by regular banks.

For extra protection, we insure every deposit you make into your monicredit account.

In the app compatible with different operating systems (iOS, Android)?

Yes it is available on playstore and Apple store

Do you give loans?

No, Monicredit does not offer loans. We specialize in payment and digital banking services, specifically through our state-of-the-art Wallet Services. Designed to seamlessly bridge the gap between traditional banking and digital convenience, our Wallet services empower you to manage your funds effortlessly and securely.

How will you add money to my Monicredit account?

There are several ways to add money to your Monicredit account: You can transfer money to your account from any Nigerian bank with a bank app or through internet banking.

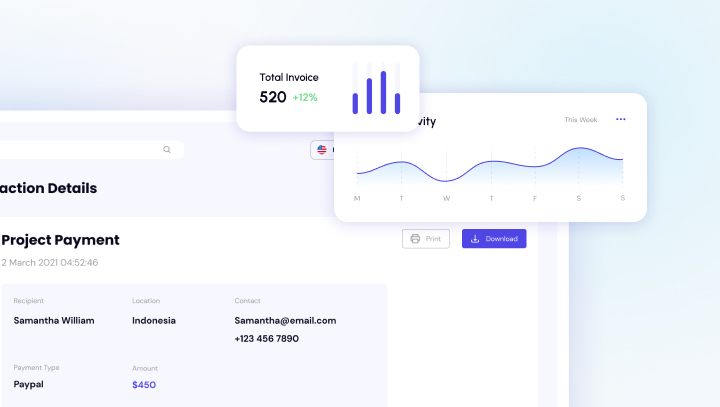

Will I get account statements?

Yes, you can request an account statement for a specific time period.

To request an account statement, click “Account Statement” on your home page.

Note: This can be used as proof of funds.

Are there any charges when requesting for a statement of account?

No! It’s completely FREE.

There are no charges on softcopies of a statement of account.

To request an account statement, click “Account Statement” on your home page.

Note: This can be used as proof of funds.

What should I do if I need help?

The easiest way to reach us is to tap your profile and click help & Support.

You can also send an email to [email protected] or call +234 803 062 3298